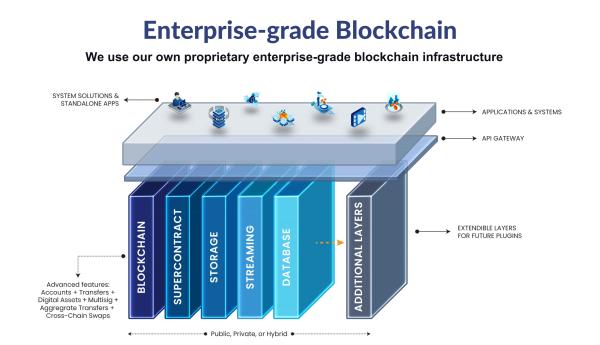

Dragonfly solves legacy problems like complex infrastructure, slow transactions, and low interoperability with a product suite powered by private enterprise-grade distributed ledger technology built for the banking industry.

Unlike its competitors, Dragonfly's technology uniquely allows an operator to control and pre-approve all network transactions to comply with existing banking operating procedures and regulatory rules, including reverse transactions, freeze assets, and replace lost or compromised accounts.

NCore

The Dragonfly CBDC solution combines the best of traditional and blockchain-based finance, empowering governments and financial institutions with fast, secure, and private transactions. Participating Financial Institutions (PFIs) can access private transactions only visible to the counterparties and the overseeing central bank or regulators. They can also open dedicated interest-bearing accounts with central banks without affecting existing customer deposits.

Our CDBC solution helps central banks monitor cash flows and reserves in real-time for accurate policy-making. It also mitigates money laundering and terrorist financing risks, besides optimizing compliance.

mWallet

Leveraging nCore, Dragonfly has built the world’s first blockchain-powered mobile wallet—mWallet—to help connect businesses and customers in a secure, scalable, and cost-efficient manner. Companies can use this product to build functional digital payment solutions for multi-currency transactions, merchant payments, exchanges and remittances, payrolls, payment aggregation, and loyalty points.

Our future-ready wallet also supports CBDCs. Wallet operators can be first to market for national CBDC rollouts and reap the benefits of in-built data management and user authentication tools.

Sirus Digital Identity

As the world becomes increasingly reliant on online interactivity, the security and privacy of personal data and identity become highly vulnerable and difficult to manage.

SiriusID, a blockchain-powered digital identity solution that is W3C compliant, enables control and ownership of personal information without fear of theft or abuse.

Zero Knowledge Proofs

Credentials are zero-knowledge proof, meaning they can be sufficiently trusted to the extent that no personal data is required to verify a claim.

In the event that personal data is requested, a user can selectively share what data is revealed.

Access & Recovery

Access to services and restricted environments can be granted by scanning a QR code or via facial recognition, whilst maintaining the user’s anonymity. Recovery of SSI and credentials is done by appointed delegates signing off or through facial recognition to verify the user’s identity. This is managed by ProximaX’s Supercontracts, where off-chain programmable rules govern recovery.

nCore Payments

The Dragonfly nCORE Payments Platform uses mWallet to help companies develop fully-functional e-Wallet services for a cohesive payment and settlement ecosystem comprising service providers, merchants, and end-users. Companies can launch individually branded platforms in a few months that are user-friendly and affordable, boosting adoption rates from their clients. They can further innovate novel revenue streams through these platforms for even stronger value propositions.

Wealth Management

The Dragonfly nCORE Wealth Management platform allows companies to create new financial instruments and funds easily. Its wide scope accommodates products like bonds, real estate, precious metals, derivatives, currency baskets, and ETFs. Besides issuing funds, companies can also manage dividend payouts, OTC transactions, and registrars of holders using our platform.

nCore CBDC

The Dragonfly CBDC solution combines the best of traditional and blockchain-based finance, empowering governments and financial institutions with fast, secure, and private transactions. Participating Financial Institutions (PFIs) can access private transactions only visible to the counterparties and the overseeing central bank or regulators. They can also open dedicated interest-bearing accounts with central banks without affecting existing customer deposits.

Our CDBC solution helps central banks monitor cash flows and reserves in real-time for accurate policy-making. It also mitigates money laundering and terrorist financing risks, besides optimizing compliance.

_0.png)

%20Overview%202023_Page_6_0.jpeg)

-Overview_Page_2_0.jpeg)